| Western Asset Prem Inst Liq Res Cap (WAAXX) | 5.42 |

| DWS ESG Liquidity Inst (ESGXX) | 5.40 |

| State Street Inst Liq Reserve Prem (SSIXX) | 5.39 |

| Allspring Heritage Select (WFJXX) | 5.36 |

| Federated Hermes Inst MM Mgmt IS (MMPXX) | 5.36 |

| Invesco Premier Investor (IMRXX) | 5.37 |

| First American Ret Prime Obligs X (FXRXX) | 5.36 |

| Allspring MMF Prm (WMPXX) | 5.36 |

| UBS Prime Preferred Fund (UPPXX) | 5.35 |

| Federated Hermes Prime Cash Oblig WS (PCOXX) | 5.35 |

| Federated Hermes Muni Obligs WS (MOFXX) | 3.77 |

| Vanguard Municipal MMF (VMSXX) | 3.57 |

| Allspring Nat Tax-Free Prem (WFNXX) | 3.56 |

| Dreyfus AMT-Free T-E Cash Mgmt Ins (DEIXX) | 3.55 |

| Fidelity Inv MM: Tax Exempt I (FTCXX) | 3.55 |

Money Market News

MORE NEWS »Crane Data's latest monthly Money Fund Portfolio Holdings statistics will be sent out Thursday, and we'll be writing our regular monthly update on the new April 30 data for Friday's News. But we also already uploaded a separate and broader Portfolio Holdings data set based on the SEC's Form N-MFP filings on Wednesday. (We continue to merge the two series, and the N-MFP version is now available via our Portfolio Holdings file listings to Money Fund Wisdom subscribers.) Our new N-MFP summary, with data as of April 30, includes holdings information from 972 money funds (down 3 from last month), representing assets of $6.425 trillion (down from $6.492 trillion). Prime MMFs inched down to $1.377 trillion (down $25.9 billion), or 21.4% of the total. (Note too that there were no funds reclassifying away from "Prime" in the SEC's latest monthly data set.) We review the new N-MFP data, and we also look at our revised MMF expense data, which shows charged expenses inching higher and money fund revenues hitting a record $17.3 billion (annualized) in April.

Inside Money Fund Intelligence

MFI PDF May 2024 Issue |

Largest Money Fund Managers |

|

|

The May 2024 issue of Money Fund Intelligence features: "Goldman Latest Prime Inst Exit; CP/CDs Should Be Okay," which covers the continued exodus from Prime Institutional MMFs; "Corporate Treasurers Leaning Away from Prime, to SMAs," which quotes quotes from recent TEXPO 2024 & NEAFP conferences; and, “NY Fed Says Money Funds in Europe Reflect Rates Fast Too," which reviews reviews an article from The Federal Reserve Bank of NY. Each monthly issue of Money Fund Intelligence features news, performance information and rankings on money market mutual funds. Statistics include: assets, weighted average maturity, weighted average life, expense ratio, 7-day yield, 30-day yield, 1-year, 3-yr, 5-yr, 10-yr, and since inception return, as well as 7- and 30-day gross yields. MFI also contains tables of the top-yielding and the largest money funds, and our benchmark Crane Money Fund Indexes. Subscriptions are $500 a year, and include online access to archived issues and additional features. Bulk discounts and site licenses are available. Write info@cranedata.com or call 1-508-439-4419 to subscribe or to request more information. |

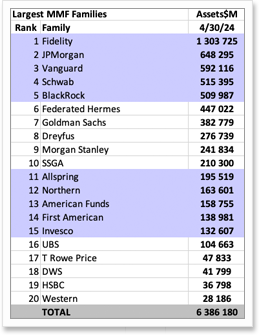

The table below is excerpted from our monthly spreadsheet product, Money Fund Intelligence XLS. It shows the largest money market mutual fund managers as of April 30, 2024. (MFI XLS contains percentile rankings, fund family rankings, MNAVs, WLA, portfolio composition, and more).

|

|

About Crane Data LLC

Crane Data is a money market and mutual fund information company founded by Peter G. Crane and Shaun Cutts. We collect money market mutual fund, bank savings, and cash investment performance, statistics, and information and distribute rankings, news, and indexes.

Crane Data publishes Money Fund Intelligence, Money Fund Intelligence XLS, Money Fund Wisdom, the Crane Money Fund Indexes, and a series of products tracking money markets, mutual funds and cash investments. We also produce conferences, including Crane's Money Fund Symposium. For more information and samples, e-mail info@cranedata.com or call us at 1-508-439-4419.

Link of the Day

MORE LINKS »

May 08

Berkshire's Buffett Still King of Cash

Bloomberg writes, "Berkshire Cash Hoard Scores Another Record as Earnings Gain," and The Wall Street Journal writes, "WSJ Buffett Rules Out ‘Eye-Popping’ Returns. But Investors Aren’t Listening." The former tells us, "Berkshire Hathaway Inc.'s cash pile hit yet another record as billionaire investor Warren Buffett confronted a ...

People

more »

May 05

In Memorium Dallas Ebel

We were shocked and saddened to learn of the sudden passing of Dallas Ebel recently. Ebel most worked for Ramirez Asset Management, and had previously been at BlackRock and Bank of America. Our deepest condolences to his family and friends. (See the Obituary here.)

Apr 24

Birdthistle Out at SEC; Vij Greiner In

A press release tells us, "The Securities and Exchange Commission ... announced that William Birdthistle, the Director of the Division of Investment Management, will depart the agency.... Natasha Vij Greiner, currently the Deputy Director of the Division of Examinations, will be named Director of the Division of Investment Management."

Mar 04

GLMX Promotes Giglio and Wiblin

A release titled, "GLMX Promotes Giglio and Wiblin as Expansion Continues" says, "GLMX, a comprehensive global technology solution for trading Money Market instruments, including repurchase agreements, ... announced [that] Sal Giglio, previously COO and Chief Markets Officer, has been promoted to President and Chief Revenue Officer. Andy Wiblin, previously Chief Product Officer, has been promoted to Global Chief Operating Officer."

Crane Data News & Features

contact us »Money Fund Symposium Pittsburgh, 6/12-14

Get ready for Crane Data’s big show! Money Fund Symposium will be held June 12-14, 2024, in Pittsburgh, Pa. Register and make hotel reservations soon. Also, thanks to those who attended our recent Bond Fund Symposium in Philadelphia! Next year's BFS will be held March 27-28, 2025 in Newport Beach, Calif. Mark your calendars for our European Money Fund Symposium, which will be in London, Sept. 19-20, 2024, and our Money Fund University, which will be in Providence, Dec. 19-20, 2024. Conference recordings and materials are available at the bottom of our "Content" page. Watch for more details on future shows in coming months, and let us know if you'd like more information. We hope to see you in Pittsburgh in June, in London in September or in Providence in December 2024!